Our VAT Calculator helps you quickly add or remove Value Added Tax (VAT) from a price, making it easy to find the net or gross price, VAT amount, or total cost. By entering a price and VAT rate, the calculator instantly shows accurate results for invoices, receipts, and everyday purchases. It’s useful for both businesses and consumers who want to avoid manual calculations and ensure VAT is applied correctly.

What Is VAT (Value Added Tax)?

Value added tax (VAT) is secondary or indirect tax that is applied at every level of production and delivery for services and good. Different business and companies get the VAT from sales and subtract the VAT which they pay on purchases, which they pass the differences to the government, and the final price is paid by the customers always. VAT is an important source of income in many nations, particularly those in the European Union, and is more difficult to avoid than sales tax since it is charged at every stage of the supply chain.

VAR rates are usually different by county and the category of products, and in basic needs such as food, medicine, and education they frequently are treated with lower or zero rate tax. Due to the fact that Vat is percentage based method, having a better understating of it and knowing the calculation process correctly is crucial for both the businesses and customers when setting prices or estimating expenses.

How VAT Works

Depending on the value contributed to the products or services, VAT is charged at every point in the supply chain. Companies get or collect the output Vat on sales and their input vat is paid in their purchases, and then the difference is payed to tax authorities. VAT is collected during the production and distribution process, and as we said before the customer is paying for the entire amount. Because of this strategy, VAT is effective, challenging to avoid, and utilized by governments worldwide. Using our vat calculator is helpful for both the consumers and business to quickly add ore remove vat without the need of manual calculation which can lead to mistakes.

Input VAT vs Output VAT

Input Tax is the type of tax that a business pays on products and services it buys, while the Output Tax is that is charged to the clients on sales. Output Vat must be paid to the tax authorities, while the Input VAT is often recoverable, meaning it can be regained.

The difference between both input or output is that it determines if business has to pay the vat or it is received as refund. Because of these approach the vat can only be paid on the values that is added in each stage of production.

VAT Inclusive vs VAT Exclusive Prices

VAT inclusive pricing, which display the entire amount a client pays, including VAT, can often be required in business-to-consumer (B2C) transactions to maintain transparency and prevent unexpected fees. While the VAR exclusive pricing shows the base costs before tax and allows customers to claim their vat back, and usually is used in business-to-business (B2B) transactions.

Having a better understanding of the differences is crucial for pricing, bookkeeping, and legal compliance. Exclusive pricing helps companies to have a better tracking of expenses and handle VAT reporting, while inclusive pricing helps the consumer experience by avoiding “tax shock.” Depending on local VAT laws and whether you are selling to consumers or other businesses, you must use the appropriate format.

VAT vs Sales Tax

Both VAT and Sales Tax are type of tax that are paid by the final customer when they are buying a product or service. For both of them one of the main differences is the process how they tax is collected. Every stage of the production and sale of a product is subject to VAT, but each company only pays tax on the value it adds. While sale tax the only time that it can be charged is ate the final sale to customers.

By adding vat to sales and allows companies to recover the vat they spent on costs, and vat helps businesses keep accurate records and minimize tax evasion. While vat is widely utilized in Europe and many other regions, sales tax is easier for businesses to apply and is mostly used in the United States. For both methods, the final customers pays the tax, but companies go through a different procedure.

What Is a VAT Calculator?

Our vat calculator a tool that is helpful for users when they need to quickly calculate vat amounts, net prices (excluding VAT), and gross prices (including VAT). It easily allows for to add or remove vat using standard, reduced, or custom tax rates. The vat calculator is commonly used when businesses need to do financial planning, tax compliance and invoicing. Customers use it to determine the actual price of goods and services before or after tax. When you use our vat calculator you reduce the mistakes than can happened and save time when compared to manual calculation.

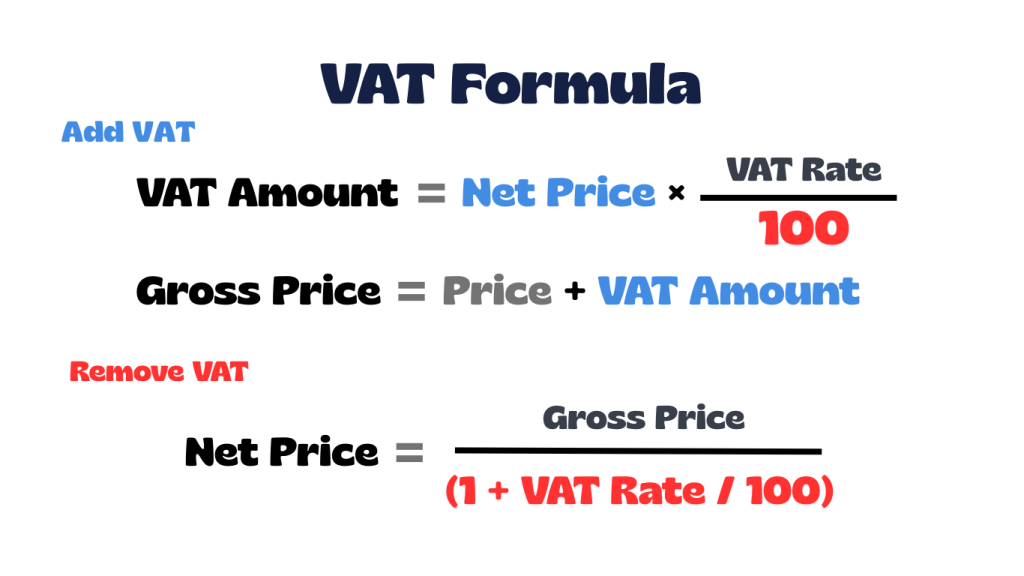

VAT Formula

How to Calculate VAT Step by Step

Value Added Tax (VAT) as we have said before is added to the price of goods and services, but sometimes you may also need to remove it to find the net price. Using a VAT calculator or following simple steps can make this process fast and accurate. Below are the steps to calculate vat by using the above formulas.

- Identify the Net Price and VAT Rate – Determine the price before tax and the applicable VAT percentage (e.g., 20%).

- Calculate VAT Amount (Adding VAT) – Multiply the net price by the VAT rate.

- Find the Total Price (Gross) – Add the VAT amount to the net price.

- Remove VAT from Gross Price – Divide the total price by 1 plus the VAT rate to get the net price.

VAT Calculation Examples

Adding VAT:

- Net Price = £100, VAT Rate = 20%

- VAT Amount = £100 × 0.20 = £20

- Total Price (Gross) = £100 + £20 = £120

Removing VAT:

- Gross Price = £120, VAT Rate = 20%

- Net Price = £120 ÷ 1.20 = £100

- VAT Amount = £120 − £100 = £20

Common VAT Rates by Region

VAT ( or Goods and Services Tax – GST) have different rates which varies across the world based on the region, with Europe having the most highest rate and along with other regions having lower rates. The majority of nations set lower rates for necessary goods and services.

Europe: One of highest in the world, which typically can range from 19% to 27%.

- Highest Rates: Hungary (27%), Croatia, Denmark, Sweden (25%), Finland (25.5%).

- Lowest Rates: Luxembourg (17%) and Malta (18%).

- Other Key Rates: Germany (19%), France (20%), UK (20%) Italy (22%).

Asia-Pacific: Generally the rates are lower and simpler, with range from 5% to 15%.

- Example rates include: Australia (10%), Japan (10%), Singapore (9%), and China (13%).

Middle East: Here VAT is relatively a new method applied, with rates that usually range from 5% to 15%.

- Example rates include: Saudi Arabia (15%), UAE and Oman (5%), Iran (9%), and Kuwait and Qatar has no VAT.

Africa: Here commonly the VAT rates have a range from 14% to 20%, with the exceptions of Nigeria that has 7.5% rate.

- Southern/Eastern Africa: South Africa (15%), Kenya (16%), Tanzania (18%).

- North/West Africa: Egypt (14%), Morocco (20%).

America: Here the rates typically have a range from 5% to 22%. Also here the region that makes an exception is Panama which has a rate of 7%.

- Example rates include: Chile (19%), Colombia (19%), Argentina (21%), and Uruguay (22%), Canada (5%)

Note: VAT rates are subject to change. The data above reflects available information for 2026.

When to Use a VAT Calculator

Our Vat calculator can be used when you need to quickly and accurately add vat to a net price or to remove it from a gross price. It is especially helpful for managing various VAT rates, creating invoices and receipts, reclaiming VAT on company costs, and making sure tax laws are followed. The vat calculator is helpful to minimize mistakes and to save time by making calculation in automatically not manually, and especially when you are handling several invoices, or complex pricing situations.

Also, it makes it easier for customers to view the tax amount, which improves budgeting and transparency. Vat calculator eliminates the misunderstandings and ensures that prices are always determined accurately for both customers and companies.

Common VAT Calculation Mistakes

One of the most common mistakes that can happen when calculating vat is to use the wrong method to remove it, like calculating the direct percentage instead of dividing it by “ 1 + Vat” rate. Some other common mistakes that can happen include to apply the wrong vat rate to products or services, mistaking zero-rated with exempt products, and reclaiming VAT on nondeductible expenses. Companies often commit vat mistakes due to improper way of keeping accurate records, accidentally calculating the same invoice twice, using outdated accounting software, or failing to remember when they must register for VAT. When selling internationally, VAT can also become complex, particularly if the rules determining where VAT should be collected are not understood.

To avoid these type of problems it needs to do and have accurate vat calculation by using the right formula, verifying the exact tax rates, or to use reliable accounting or Vat calculator tools which can help you to avoid these errors that can counter and the vat calculation accurate.

VAT Calculator for Businesses vs Individuals

How a vat calculator can be used is different based on the type of user that you can be which you might be a customers or business. For tax reporting and compliance, businesses use it to determine how much VAT they must pay or recover by deducting VAT from gross amounts or adding VAT to net prices. VAT calculator is primarily used by customers to determine the total cost of their purchases, including tax. Customers use the tool for simpler things and mainly focused on the overall cost transparency, while the businesses use it to handle various VAT rates and concentrate on net vs. gross data. In both cases, a VAT calculator helps avoid manual mistakes and ensures prices and taxes are calculated in the proper way.

Frequently Asked Questions (FAQs)

1. How do I calculate how much VAT I owe the government?

You usually pay the difference between the VAT you charge customers (Output VAT) and the VAT you’ve paid on business expenses (Input VAT). If your Input VAT is higher, you may be able to claim a refund or carry it forward.

2. What’s the difference between zero-rated and exempt VAT items?

Zero-rated items are taxed at 0%, but they’re still considered taxable, so businesses can reclaim VAT on related costs. Exempt items don’t have VAT charged at all, and VAT paid on related expenses cannot be reclaimed.

3. How do I add VAT to a price?

To add VAT, multiply the net price by 1 + the VAT rate (for example, × 1.20 for 20% VAT). You can also use our VAT Calculator to do this instantly.

4. How do I remove VAT from a total price?

To remove VAT, divide the gross (VAT-inclusive) amount by 1 + the VAT rate (for example, ÷ 1.20 for 20% VAT). Our calculator handles this automatically for you.

5. Can travelers get a VAT refund?

In many countries, non-residents can claim VAT refunds on eligible purchases when leaving the country. This usually requires original receipts and a stamped refund form at the airport.

6. Can I use this VAT calculator for different countries?

Yes. As long as you enter the correct VAT rate, the calculator works for any country, including the UK, EU nations, and other regions with different VAT percentages.

7. Why can’t I just subtract 20% to remove VAT?

Because VAT is calculated on the net price, not the total. Simply subtracting 20% from a VAT-inclusive amount gives an incorrect result. Dividing by 1.20 is the correct method.

8. Who is required to charge VAT?

Only businesses that are registered for VAT with their tax authority are legally allowed to charge VAT on their sales.

9. What happens if I use the wrong VAT rate?

Using an incorrect VAT rate can lead to inaccurate invoices and tax filings, which may result in penalties or extra payments to tax authorities.

10. Should prices be shown including VAT?

In many regions, especially in the EU, prices shown to consumers must legally include VAT to avoid misleading customers.

11. How is VAT handled on discounted items?

VAT is calculated on the final discounted price, not the original price before the discount.

12. Are some items completely exempt from VAT?

Yes. Certain goods and services, such as healthcare, insurance, and some education services, are VAT-exempt. VAT on related expenses cannot be reclaimed.

Explore More Percentage Tools

Explore more percentage calculators to help with different types of percentage problems from our site. Our tools are designed to make it easy to work out with percentage increase, decrease, change, difference, and much more tools that are only related to percentage calculations. Click any calculator below to continue solving percentage questions quickly and accurately.

Markup Calculator

Shows how much you need to add to your cost price to reach a desired selling price or profit percentage.

Margin Calculator

Helps you quickly find profit margin, profit, cost, or revenue by comparing selling price against costs.

Percentage Change Calculator

Finds how much a value has increased or decreased from its original value in percentage terms.

REFERENCE

The VAT Calculator on this page is based on standard mathematical definitions and explanations from trusted educational resources: